Your Guide to Customer Acquisition Costs & Customer Lifetime Value

Would you like to see the return on your marketing investment? Or evaluate how good your sales team are at upselling existing customers? Or even understand how loyal your customers are?

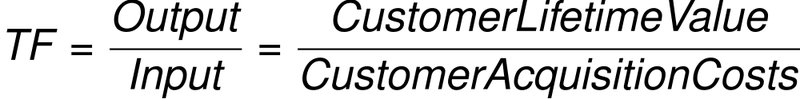

Many businesses use just two metrics to get answers to these questions. By understanding their Customer Acquisition Costs (CAC) and Customer Lifetime Value (CLV), these businesses are planning for financial success.

Let’s look at some definitions.

CAC is the sum of money you pay to gain a customer. And CLV is the profit you make from each customer.

Yes, you guessed it. They are related. If you know that your CLV is £1000, then you should feel comfortable in spending £50 to acquire a customer.

Understanding CAC

CAC is a marketing metric, and possibly the most important one. If you understand it, you will see which of your marketing channels (from digital through to events) works best. And you’ll be able to benchmark your costs against competitors. To get a good understanding of your CAC, you’ll need to monitor it well - with clean data and clear reports. Your sales and marketing teams should be reviewing CAC (and CLV) at quarterly meetings and planning how to improve. The more your teams know about CAC and which channels perform best, the more they’ll focus their efforts on pursuing the more profitable leads and upselling the most engaged customers.

A Closer Look At CLV

CLV should also feature on your executive dashboard. By understanding your CLV, you will feel confident in planning for the future. Know your numbers and, if they’re good, you’ll be in a position to give the go ahead for a new customer services team, or the calls for more product development. And if your numbers aren’t good, you’ll feel justified in scaling back investment to reasonable levels. Regular monitoring of CLV is essential for making the right decisions, at the right time. If your CLV drops it could indicate a problem in your business - perhaps once-loyal customers are choosing to take their money elsewhere.

Both CAC and CLV affect how much money you make, and how much you have to spend. If your monitoring suggests a weakening in these metrics, you’ll want to seek the help of a financial advisor. They can help you understand the impact on your bottom line and guide you to make the most out of every pound you spend on sales and marketing.